Money

Financial adviser Dick Mody discusses the benefits of family floaters vis-à-vis individual mediclaim plans

As the adage goes, ‘If you have wealth you have something, but if you have health you have everything!’ This is especially true for elders. While providing valuable practical information to silvers, I also have a message for our younger readers: Take the onus of securing the wellbeing and good health of your elders by gifting them a mediclaim plan, even if they resist!

Healthcare costs are rising

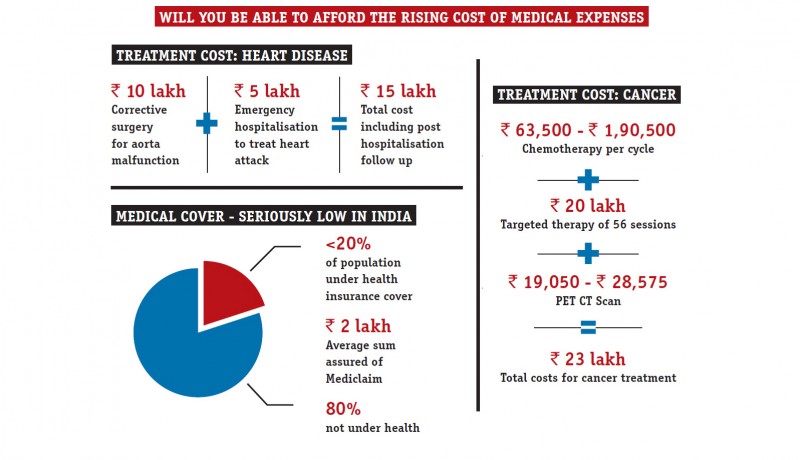

Two major areas of ‘non-discretionary’ (unexpected or unavoidable) expenses have seen a sharper rise over the past few years compared to normal day-to-day expenses: the first is education; the second is medical treatment. And I don’t expect either of these trends to reverse. In fact, things can get even more difficult if there is a critical or prolonged illness in the silver years. For its part, the Government continuously keeps a close watch on the cost of medicines and has taken some remarkable decisions in the past two years; according to recent newspaper reports, this has resulted in a reduction ranging from 5 per cent to 40 per cent in the cost of more than 851 drugs. Yet, looking at medium to long-term trends, the following developments may keep healthcare costs elevated:

- Improvement in hospital infrastructure

- Upgrade to seek specialised professional consultancy versus OPD

- Newer technologies that will demand a premium

- Import of critical medical devices that will come with the above technologies

- Occurrence of lifestyle diseases at a much earlier age given the rapidly changing, high-stress socio economic environment

How do we plan for such a potential scenario?

Any uncertainty in life can never be predicted or eliminated fully. However, one can be proactive in anticipating it and, hopefully, planning for it. Indeed, having a well-rounded medical protection plan for your family, including silvers, is the need of the hour. This is even more significant in our country, where, unlike the West, there is hardly any government-sponsored safety net for future medical needs. In this context, it is worth pointing out that in developed countries like the US, UK, Norway and Japan, there is increasing debate on cutting back on the medical facilities the government provides to residents. On the other hand, the Government of India has recently announced its intention to start comprehensive mediclaim cover for more than 50 crore Indians in the lower-income group, up to ₹ 5 lakh per family per year. This will take time to implement and everyone may not be eligible. Thus, planning is the key.

Mediclaim insurance is more complicated than we think

As a financial consultant for the past 30 years, I have analysed and advised on almost every financial product after careful study. But rarely have I come across a product more difficult to understand than medical insurance. The reason is that there are multiple products with various features/exclusions from scores of insurance companies and a general lack of knowledge-sharing with the customer on the pros and cons. More often than not, when there is an unsettled claim, a partially settled claim or a full rejection, there is a feeling of betrayal at the customer’s end. While this article does not intend to deep-dive into the matter, I sincerely advise readers to not go on face value alone—please ask your advisor all the right questions before signing up.

Family floaters score over individual mediclaim plans

I always advise families with up to three children to opt for a family floater plan. For instance, instead of going for ₹ 3 lakh of mediclaim per family member, one can choose a ₹ 15 lakh floater, which can be used by one or more persons in the coverage year (see box).

| Mr and Mrs Shah take a family floater of ` 15 lakh for their family comprising themselves and their three children A, B & C | |

| Total floater cover available | ₹ 15 lakh |

| Mr Shah’s hospital expenses | ₹ –5 lakh |

| Balance cover | ₹ 10 lakh |

| Master A’s hospital expenses | ₹ –1 lakh |

| Mrs Shah’s hospital expenses | ₹ –4 lakh |

| Balance floater cover left for family | ₹ 5 lakh |

As you can see, in the event of multiple claims in any year, the family is protected for a much higher amount compared to ₹ 3 lakh each individually. Usually, the premium is also competitive for floaters, so I advice readers to strongly consider floaters issued by leading, new-generation private health insurance companies. Feel free to contact us for more details.

Plans are now available for silvers and those with pre-existing ailments

With the advent of private-sector competition in the health insurance sector, consumers have cause for cheer. Several leading private insurance companies offer specific plans catering to the mediclaim needs of senior citizens (aged 60 and above), cancer-affected persons, cardiac patients and persons with diabetes.

Plans for senior citizens must be studied carefully for restrictions, especially with regard to coverage of pre-existing diseases (PED) as some insurance companies have a three to four year wait period before which you cannot claim for PED-related hospitalisation. You must understand the co-payment clauses for PED and all claims before buying a plan as most policies list these in fine print. Also not many policies provide outpatient (OPD) cover, so please be very careful.

We usually advise silvers up to 75 years of age to avail of highly competitive mediclaim plans that have no pre-acceptance medical screening and guaranteed lifelong renewals. These plans can be bought for as much as ₹ 10 lakh per annum cover. In the latest Budget, the limit for deduction under Section 80D for senior citizens’ premium on health insurance has been increased from ₹ 30,000 to ₹ 50,000. Also if you are paying for your parent (who is a senior citizen above the age of 60), you can maximise your tax benefit to a total of ₹ 55,000.

Choose wisely

Select a senior citizens’ plan only after consulting a qualified advisor. Avoid the temptation of going online and buying the cheapest cover without fully understanding the features—this will be a penny-wise pound-foolish strategy that may hurt you in the long run when a major claim is triggered. And once you select a plan, stick with it and regularly renew it.

Dick Mody, a 25-year veteran in the Indian equity markets, is the founder-CEO of Ethical Advisers. Write to us with your financial queries at contact.us@harmonyindia.org and Mody will answer them in this column. You can also reach him directly at dhm@ethicaladvisers.in or visit www.ethicaladvisers.in

Featured in Harmony — Celebrate Age Magazine April 2018

you may also like to read

-

Pension hike

The stage is set for a manifold hike in pension for private-sector employees with the Supreme Court quashing a special….

-

Budget 2019: ‘A big let-down’ for silvers

The verdict is out: Experts Harmony-Celebrate Age spoke to termed Budget 2019 ‘a big let-down’ for silvers. The only saving….

-

Silvers seek sops in health sector in Budget 2019

Relief in the healthcare sector seems to be uppermost in the minds of silvers on the eve of the unveiling….

-

Cheer for pensioners

The Union Government has launched Sampann (system for accounting and management of pension), a pension management software to aid and….