Money

Financial adviser Dick Mody analyses ideal insurance plans for silvers

This month’s topic is life insurance. And it may be appropriate to start with a quote I had seen in an advertisement on a business trip to Europe: “You don’t buy insurance because you are going to die, but because you love the ones who are going to live.” What a simple, yet powerful message!

Yes, the primary objective of life insurance is to provide financial security to your dear ones in case of any unforeseen or premature demise of the primary income earner in the family. And after the advent of private insurance companies in India, and proactive regulatory oversight, this industry has seen a lot of change and innovation. Earlier, one would buy only enough insurance to help save tax but, today, insurance planning is an inseparable part of any individual or family’s long-term financial strategy. Most important, I wish to destroy the myth that insurance is just for young people and highlight how silvers can benefit from it too.

What is the concept of ‘life’ in general?

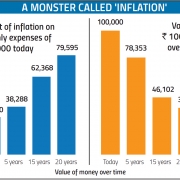

It does not take rocket science to know that human life can be short (owing to unfortunate events) or long. Both scenarios need planning: one for the family and one for your own self. In the first scenario, life insurance provides stability and security to the family; in the second, it ensures financial independence in your non-earning years (which may be a good 15-20 years or more) and equips you to face inflation. We know that the cost of even basic items and services of daily use will rise every year while our incomes may or may not, especially after retirement.

Please tell us more about LIC’s Varishtha Bima Yojana.

I often get asked about the Varishtha Bima Yojana, which was recently announced for senior citizens above the age of 60. It’s important to understand that this is not an insurance scheme but a pension plan! The life of the assured is not covered—instead, merely a fixed rate of return is offered. Thus you can invest up to ₹ 7.5 lakh and get a pension at 8 per cent per annum for 10 years, which is ₹ 5,000 per month or ₹ 60,000 per annum—but you will have to pay tax on this earning. Thus, in my view, the post-tax yield will be very low in today’s inflationary time. Besides, another issue to strongly consider is that your investment is locked up for 10 or more years. This reduces the attractiveness of the scheme as elders may want financial flexibility in case of future contingency.

What, then, are the various insurance options for silvers?

It is very important to understand the difference between pure insurance policies that pay a fixed sum on death (‘term plans’), long-term insurance-cum-savings plans that offer modest returns (‘traditional or endowment plans’) and wealth-creation plans (‘unit-linked plans’ or ULIPs). According to most independent financial advisers, a combination of a term plan plus a good wealth-creation plan is an ideal strategy to optimise your returns—depending on age of entry.

Please elaborate.

The premium on term plans rises sharply with age; hence, these are not advisable for silvers in general, unless they are absolutely required for business/mortgage-related purposes. Endowment plans have restrictions on entry age, which is a maximum of 60 or 70 years. Besides, these are not suitable for silvers as they offer relatively low returns. In most cases, please remember that nonearning silver citizens (from salary or business) are not eligible for both the above plans even if they have substantial income from investments. This is because the basic concept of insurance entails ‘compensating the survivors for loss of earning income of the person insured’.

So now let us understand in detail why ULIPs are best suited for long-term wealth creation for silvers. (Here, ‘long term’ is defined as five to seven years or more, if you choose to stay invested of course.) The basic nature of a ULIP is that it combines insurance with savings; this means that a significant part of your annual contribution towards the plan is invested for your benefit by creating an investment fund. This fund is managed by highly experienced and professional managers in accordance with your choice of asset class; for example, you can decide the split between fixed return instruments and higher return instruments. When you select your ULIP, do not go by the brand but the past track record of the fund manager as each fund in each insurance company may be managed by a specific person. Of course, you can always rely on an intelligent and experienced financial adviser to do the groundwork for you and advise you accordingly.

How are ULIPs different from mutual funds or fixed deposits?

Let’s first compare them with fixed deposits (FDs). Many of us have traditionally kept our money in three-year FDs and rolled them over regularly on maturity. The primary reason was higher interest rates. However, looking at the latest interest offered by leading banks, including SBI, to senior citizens, you see that they offer 6.75 per cent for deposits up to two years and again 6.5 per cent for deposits for any period up to 10 years! Hence, there is no incentive to lock in to higher rates even if you are prepared to keep a five or seven-year deposit. Also, not only do bank deposits yield very low rates, you have to pay tax even on the interest earned. Compared to FDs, mutual funds (MFs) are a much more liquid and tax-efficient option—you can select whatever suits your needs depending on your risk appetite.

However, ULIPs offer not only tax advantages under Sec 80C of the Income Tax Act, which MFs don’t, but give you a lot of choice, cost advantage and tax-free withdrawal on maturity. Conservative investors can also go for a 100 per cent debt-oriented ULIP or choose a mix of 75 per cent debt and 25 per cent equity, etc. Historically, even a conservative, 100 per cent debt-oriented ULIP has given tax-free returns of 9.5-11 per cent per annum. Silvers can choose a combination of MFs (hybrid or debt funds) and ULIPs, depending on how long you can keep the funds invested in each. Whatever option you choose, the longer you stay invested, the higher your returns.

Isn’t life insurance only for young adults and less relevant for silvers?

The short answer is ‘yes’. While we have discussed the merits of ULIPs as one of the best wealth creators over a five to seven-year period, it is important to highlight that, generally, depending on age, your returns will vary. Hence, to take full advantage of the plan, it is recommended that people over the age of, say, 50 or 55 years gift the ULIP to their children or grandchildren. This way, they can take advantage of the tax deduction under Sec 80C being the ‘proposers’, while maximising the returns by adding their children or grandchildren as the ‘life assured’. Mind you, just because you have chosen someone else as ‘life assured’ does not mean that you don’t get the maturity proceeds—it merely helps earn a better return. If you need any clarity on this, feel free to write in; I’d be happy to address all your doubts and questions.

Can I plan my retirement using any long-term insurance products?

There are various options in the market, including Public Provident Fund, Employees Provident Fund, National Savings Certificate, Kisan Vikas Patra and the National Pension Scheme. But I strongly advise silvers to create their own pension plan through consultation with an independent financial adviser. Besides getting a lot of flexibility in creating your own plan, the biggest benefit is that you can be sure of a tax-free, lump-sum amount (not an annual taxable payout) when the scheme matures.

Doesn’t insurance entail a lot of paperwork and multiple visits to the insurance company’s office?

No. On the contrary, most private insurance companies are going paperless. Barring the one-page proposal form, which is simple and needs your signature, most basic identity documents, including your PAN card, etc, can be submitted electronically. Also, the regulator, IRDA, has strict norms for protecting the interest of those who subscribe to any insurance-related products. It also regularly sets ceilings on the charges borne by subscribers. Intense competition among insurance companies has further reduced the expenses borne by subscribers. And there is no need to frequently visit any office as most updates are available on the company’s website by logging into your own account or via statements by post.

Dick Mody, a 25-year veteran in the Indian equity markets, is the founder-CEO of Ethical Advisers. Write to us with your financial queries at contact.us@harmonyindia.org and Mody will answer them in this column. You can also reach him directly at dhm@ethicaladvisers.in or visit www.ethicaladvisers.in

Featured in Harmony — Celebrate Age Magazine December 2017

you may also like to read

-

Pension hike

The stage is set for a manifold hike in pension for private-sector employees with the Supreme Court quashing a special….

-

Budget 2019: ‘A big let-down’ for silvers

The verdict is out: Experts Harmony-Celebrate Age spoke to termed Budget 2019 ‘a big let-down’ for silvers. The only saving….

-

Silvers seek sops in health sector in Budget 2019

Relief in the healthcare sector seems to be uppermost in the minds of silvers on the eve of the unveiling….

-

Cheer for pensioners

The Union Government has launched Sampann (system for accounting and management of pension), a pension management software to aid and….