Money

Economist Priya Desai decodes e-payment applications in a cashless economy.

It is a common sight to see silvers making regular jaunts to their banks to withdraw or deposit cash. A majority do not even have or use a debit/credit card, and have never set foot in an ATM. However, the recent cash crunch and the need to understand and use various digital payment methods have aroused their curiosity.

Silvers set a very high value on the sense of security the cash in their pockets provides. So, it’s not surprising that most are sceptical about using plastic money. I suggested to my silver friends that they should consider getting an ATM/debit card; I also offered to help them learn the ropes, but encountered a rather tepid response.

Going digital

Being a silver, I can understand the hesitation. It is obvious they harbour qualms about ATM frauds, phishing, and the unexplained disappearance of cash from accounts. A switch from cash to digital payments as a way of life will definitely be snail-paced, and it won’t take long for them to backtrack on using these mediums at the first sign of danger or failure.

We can’t overlook the possibility of silvers reverting to their comfort zone of physically visiting a bank for all banking needs. Not many want to give up on the familiar routine of leisurely traipsing to their bank to withdraw cash (in the denomination they need), depositing their cheques or updating their passbook, even as they exchange a smile and strike up a conversation with the staff at the counters.

This is especially true in the case of super seniors who eagerly look forward to these regular local trips, but don’t feel confident about remembering the correct PIN number. However, those on the threshold of senior citizenship embrace digital mediums without much hesitation.

Cashless transactions

Just as cash is an instrument of payment, digital payment instruments use electronic systems and are referred to as cashless transactions. In the absence of a clear definition, terms such as digital and electronic payments are used interchangeably. Even as technology evolves at a rapid pace, the digital payment landscape has undergone a sea change as well.

India is a cash-intensive economy. Not surprisingly, the thought of a cashless economy carries a heavy shock quotient for us. However, ours isn’t the only country that has seen such rapid changes in this space. In Canada, Mint-Chip, a digital cash platform, was launched in June 2016. MintChip ensures that electronic transactions replace physical cash with digital money; people can use a credit card to upload money from the app, just as if they were purchasing something. The app can also be used to deposit money to a bank account, from where it can be withdrawn. This is a distinct move towards a truly cashless economy.

New kids on the block

Since demonetisation, the Indian payment services market has become robust and is cashing in on the growing importance of a less-cash economy. However, all the hoopla around these advances in technology in the banking and payment landscape has skirted silvers or vice-versa.

However, as the din of e-wallets and other payment apps reaches a deafening crescendo, silvers are now being shaken out of their reverie and being coerced into learning the basics. It’s hard to ignore the almost ubiquitous Paytm, Mobikwik, Free Charge, Oxigen, and PayU logos and boards. These companies are bombarding the confused user with a tidal wave of advertisements and marketing blitzkrieg. However, what leaves users bemused is that many shopkeepers aren’t completely in the know when it comes to using these apps. Often, company representatives place the logo in the stores without necessarily training shopkeepers.

The right choice

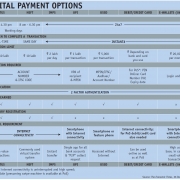

Most payment services companies are focused only on leapfrogging ahead of their competitors and gaining the highest market share, with the training aspect getting nudged into the shadows. While the common objective of all digital payments options is cashless transaction, they differ in aspects such as:

- Terms of purpose

- Timing

- Transaction limits

- Information

- Authentication

- Interest earned

- Beneficiary registration

- Technical requirements

- Others.

It is evident that choosing the best payment option will depend upon the purpose for which it is used. (The table below provides a snapshot of some of these options.) A joint study by industry association Assocham and research firm RNCOS reports that the market value of mobile payments is set to grow at a tremendous 211 per cent annually between 2016 and 2022. While mobile wallets will form the bulk of payments in the next decade, their value is estimated to balloon to ₹ 275 lakh crore. It is expected that the share of mobile wallets will jump from 22 per cent to 57 per cent in the total volume of mobile payments, and silvers will be a part of this massive movement.

Modern BHIM

The options on the platter of digital payments are growing with each passing day. While private companies are jostling to increase their market share, IDFC Bank has introduced biometric readers at merchant outlets for payments through IDFC Aadhaar Pay—a system under which people only need to have a bank account with Aadhaar linked to it to make a digital payment. The Prime Minister launched Bharat Interface for Mobile (BHIM), an app based on Unified Payment Interface (UPI) that will be common across all banks and financial institutions. This app has been described by the PM as the “biggest wonder of the world”. Some of the features include:

- No Internet connectivity required; can work on a simple feature phone

- Addition of Aadhaar-based payment on the anvil

- Money can be sent and received

- Accounts can be linked

- Language change functionality

- Recording beneficiary details

- Balance enquiries can be made.

These features aim to empower the poorest of the poor, small merchants, farmers, tribals, etc. Within a short span of its launch, BHIM has garnered an impressive user base of 3 million people, though the present version is nowhere close to being glitch-free. On the horizon are a number of developments and changes in the payment ecosystem; it seems like the only option users, silvers included, are left with is to be well-informed about these systems and move forth in tandem with the changes taking place. It is also a fact that till the time silvers are fully convinced these new systems will work seamlessly, they will continue to be mere bystanders.

Not without concerns

The concerns of silvers regarding these modes of payments are centred on standardisation, security and safety aspects. While cyber security professionals are burning the midnight oil to devise strategies to mitigate all potential security breaches, there are a number of factors that are almost counterintuitive.

For instance, most e-wallet companies have neither a risk mitigation plan in place nor any cyber insurance cover. The fact that leading e-wallet Paytm’s pre-demonetisation fraud record of ₹ 40 million per month shot up to a shocking ₹ 110 million per month after 8 November 2016 says a lot about why people are wary about adopting these systems.

Like most other people, silvers are also miffed about the fact that they have to shell out card and e-wallet related (at present, free) transaction charges, when they prefer using cash for most of their purchases and transactions. However, the transaction charges for BHIM are a notch lower than most other digital payment options. What is often forgotten is that the cash also has a cost that is borne by the banking system.

Adopt and adapt

The digital payments world is evolving at a dizzying pace, and is growing in variety and complexity. While some silvers are enthusiastic and more than willing to ride the learning curve, others continue to remain unimpressed. The only way the older population in our country will be inclined to adopt and adapt these changes is if they are made simpler and safer.

They need to be assured that these changes will redound to cushioning their comfort zone. Anxiety, fear of loss and risk are going to be a part of this journey. But they need to be convinced that it is not as risky, bad, or as inconvenient as they believe it to be.

It is incumbent on the Government, banking system and players in the digital world to pull silvers into the digital arena. Just as the Government is organising training camps for MPs, bureaucrats, party workers, police, taxi and auto drivers, training camps for silvers are the need of the hour.

Today’s silvers are spenders and account for a sizeable number, so they should not be alienated from the digital payments world. Their inclusion is an important ingredient for the successful implementation of a less-cash or cashless economy.

The author is an economist based in Mumbai

Photo: iStock Featured in Harmony — Celebrate Age Magazine February 2017

you may also like to read

-

Pension hike

The stage is set for a manifold hike in pension for private-sector employees with the Supreme Court quashing a special….

-

Budget 2019: ‘A big let-down’ for silvers

The verdict is out: Experts Harmony-Celebrate Age spoke to termed Budget 2019 ‘a big let-down’ for silvers. The only saving….

-

Silvers seek sops in health sector in Budget 2019

Relief in the healthcare sector seems to be uppermost in the minds of silvers on the eve of the unveiling….

-

Cheer for pensioners

The Union Government has launched Sampann (system for accounting and management of pension), a pension management software to aid and….